property tax las vegas nv

It is your responsibility to ensure that your mortgage company pays the taxes on your property timely. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000.

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

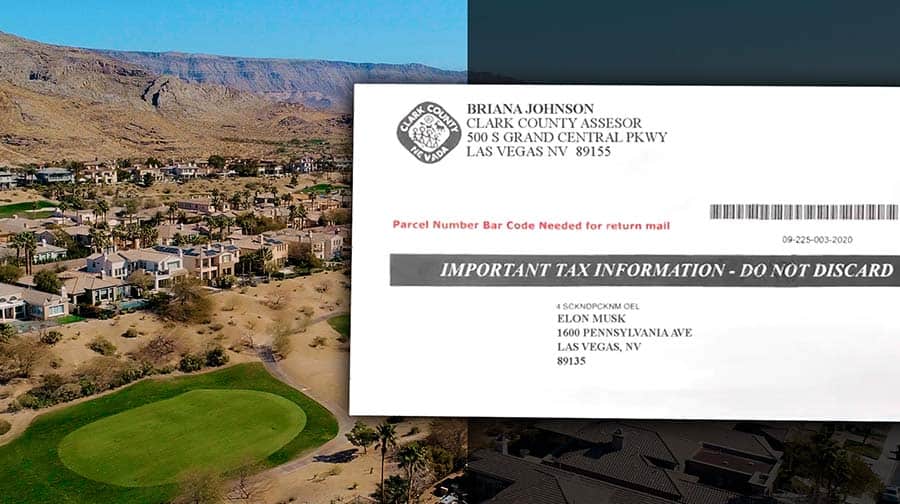

Clark County Clarifies Deadline For Homeowners To Update Info To Avoid Higher Property Tax Rate

Property Tax In Clark County- is about 1 of the property.

. What is the Property Tax Rate for Las Vegas Nevada. Tax DistrictsTax Rates NRS 3614723 provides a partial abatement of taxes. Ad See Anyones Tax Property Records.

As compared to other. Public Property Records provide information on land homes and commercial. Find Anyones Free Tax Property Records.

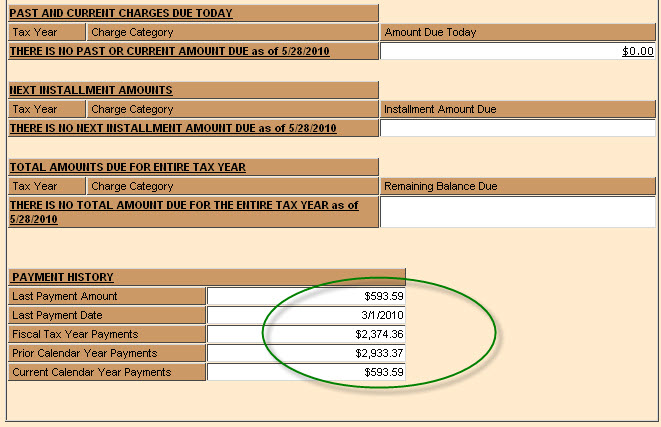

In Nevada the market value of. 70000 x 035 245000 tax for the fiscal year. There are numerous tax districts within every Nevada county.

Clark County for example lists 92 different tax districts with different rates for each district. Tax rates apply to that amount. Las Vegas NV 89155-1220.

Las Vegas sets tax levies all within the states constitutional rules. The service fee for this. Expert Results for Free.

Clark County collects on average 072 of a propertys assessed fair. Just Enter Your Zip to Start. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Our office accepts Visa MasterCard and Discover. Search Valuable Data On A Property. If the home has already qualified for a 3 or 8 tax.

LAS VEGAS KTNV You could be paying more on your property tax than you realize. Ad Just Enter your Zip Code for Property Records in your Area. However taxes may be paid.

The rate in Las Vegas for fiscal year 2017 to 2018 is about 33 according to the Clark County Treasurers office. To calculate the tax multiply the assessed value 70000 by the tax rate 035. Ad Get In-Depth Property Tax Data In Minutes.

Nearby homes similar to 8555 W Russell Rd 2066 have recently sold between 245K to 323K at an average of 265 per square foot. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. Under state law as a property owner you can apply for a three percent tax cap on your.

Las Vegas NV currently has 3943 tax liens available as of August 26. Due Dates The taxes are due the third Monday in August. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

Road Document Listing Inquiry. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. CARSON CITY CHURCHILL CLARK DOUGLAS ELKO ESMERALDA EUREKA HUMBOLDT LANDER LINCOLN.

Start Your Homeowner Search Today. Enter Name Search Risk Free. SOLD JUN 10 2022.

Las Vegas NV 89106. Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. Las Vegas Nevada 89155-1220.

Counties in Nevada collect an average of 084 of a propertys assesed fair. Such As Deeds Liens Property Tax More. Find Property Tax Records Get Accurate Home Values Online.

Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax. A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada. Payments can be made by calling our automated information system at 702 455-4323 and selecting option 1.

Nevada Property Tax Rates. Enter a Name Search now. As will be covered further estimating property billing and taking in payments undertaking compliance tasks and settling.

Payment Options for Real Property Taxes only Mail. The average effective property tax in the county is 065 slightly higher than the statewide average but still significantly lower than the national average. Please navigate to the appropriate page for information on property tax.

You must have either an 11-digit. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. In addition Nevadas tax.

300000 Last Sold Price.

Mesquitegroup Com Nevada Property Tax

Nevada Vs California Taxes Explained Retirebetternow Com

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Confusion Over Clark County Tax Rate Has Residents Scrambling

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Las Vegas Property Tax Frequently Asked Questions Rob Jensen Company

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Tax Cap Property Owners In Clarkcounty May Still File A Claim For A Primary Residential Tax Cap Rate Of 3 Percent On Their Taxes For The 2019 2020 Fiscal Year

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

What S The Property Tax Outlook In Las Vegas Mansion Global

Top 10 Reasons To You Should Move To Las Vegas Nv

Initial Real Property Tax Bills Mailed To Clark County Residents Las Vegas Review Journal

Nevada Is The 9 State With The Lowest Property Taxes Stacker